Smart Money Concepts (SMC) sounds complicated because most people explain it like a secret code. In reality, SMC is just about understanding how big players move the market and why price behaves the way it does.

Most beginner traders in South Africa lose money not because SMC doesn’t work, but because they jump into entries without understanding market structure, liquidity, and patience. This guide fixes that.

My name is Thabiso, and I’ve been a trader since 2020. I have tried more than 8 different trading strategies, but ended up finding profitability with SMC.

This guide is written for beginner traders. It is based on:

The goal is clarity, not selling dreams.

What Is Smart Money Concepts (SMC)?

Smart Money Concepts (SMC) is a forex trading stratergy that focuses on how institutions move prices using market structure, liquidity, and order flow.

Here’s what you are going to learn

All this will help you understand why prices move, and where to enter.

What Is Smart Money in Forex?

In forex trading, smart money refers to large financial institutions like banks, hedge funds, and liquidity providers. These players move the market because they trade with very large volumes.

Retail traders don’t move prices. Institutions do.

SMC teaches you how to follow their footprints instead of fighting against them.

Since Institutions need liquidity to enter and exit trades. They create Liquidity usually by targeting:

Price moves to these areas on purpose, not by accident.

Smart Money Concept Trading Strategy [PDF]

Let’s dive deep into the sources of the SMC trading strategy. I will break down every concept for choch, to fvg all in a simple way.

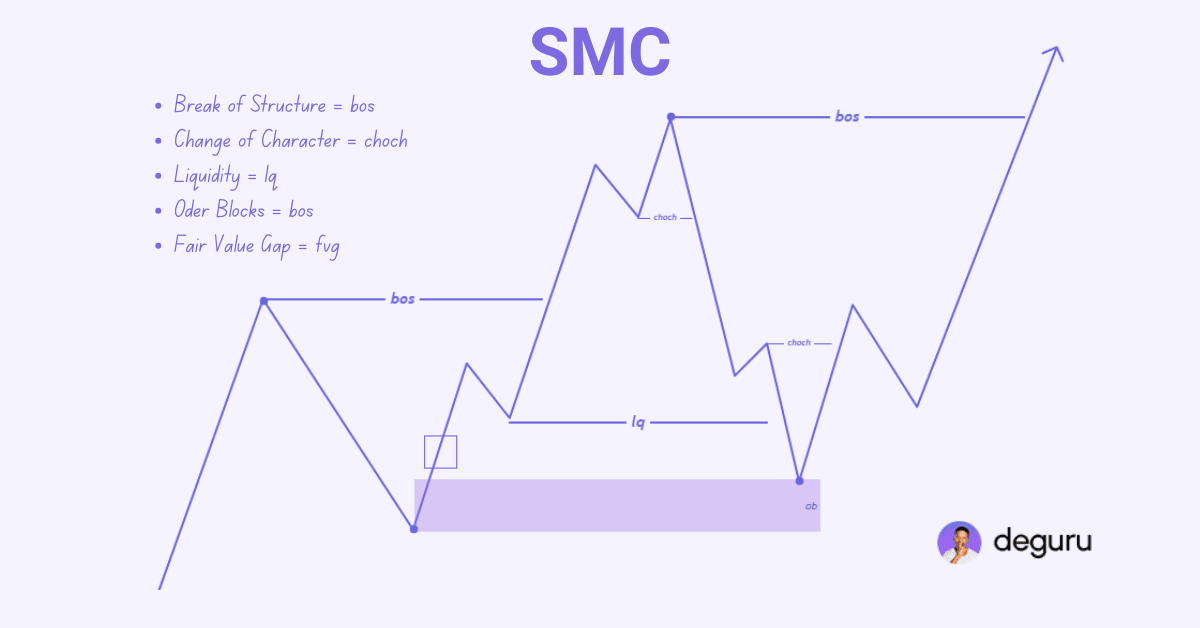

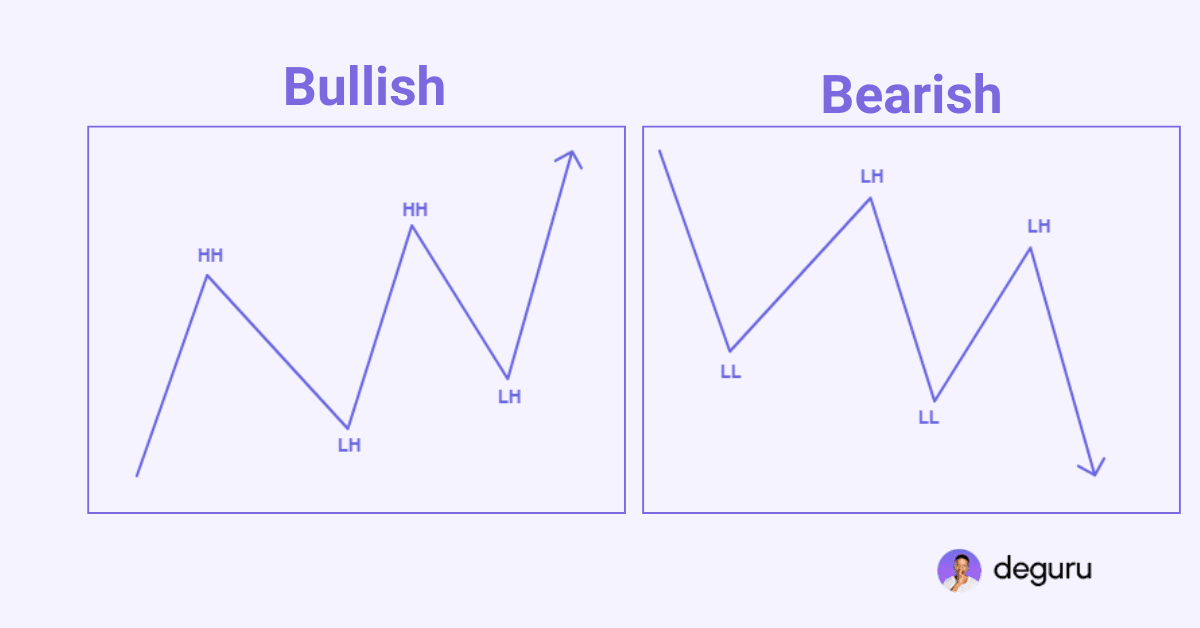

Market Structure

Market structure shows whether the price is bullish or bearish using highs and lows.

Structure always comes before entries.

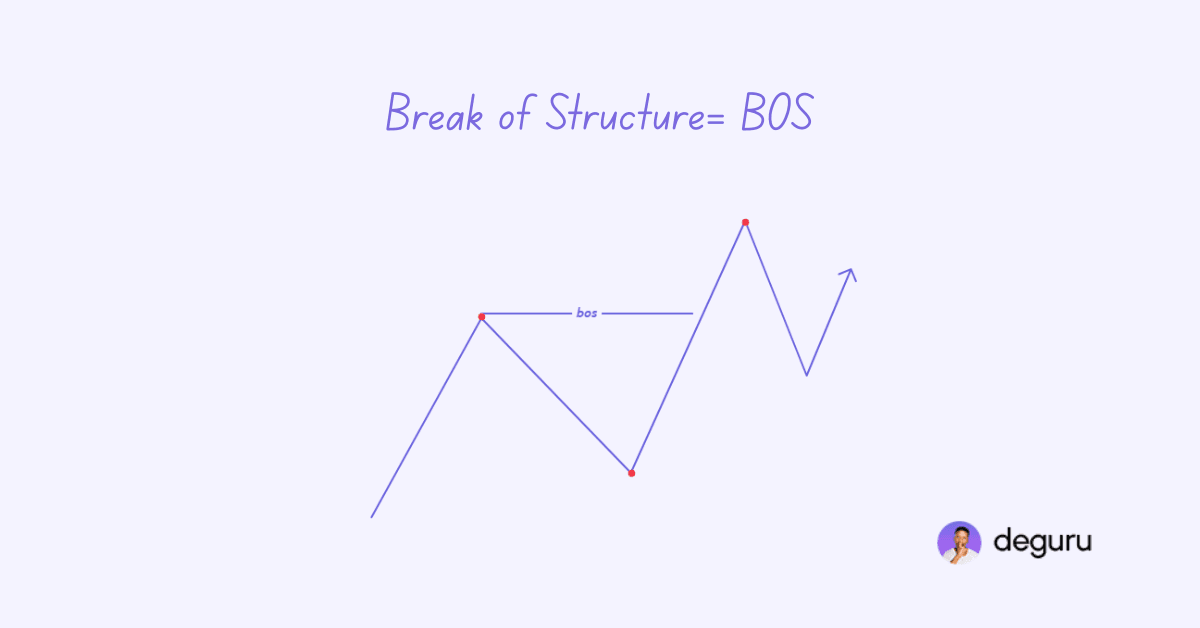

BOS (Break of Structure)

A BOS happens when the price breaks a previous high or low in the direction of the trend.

It confirms continuation.

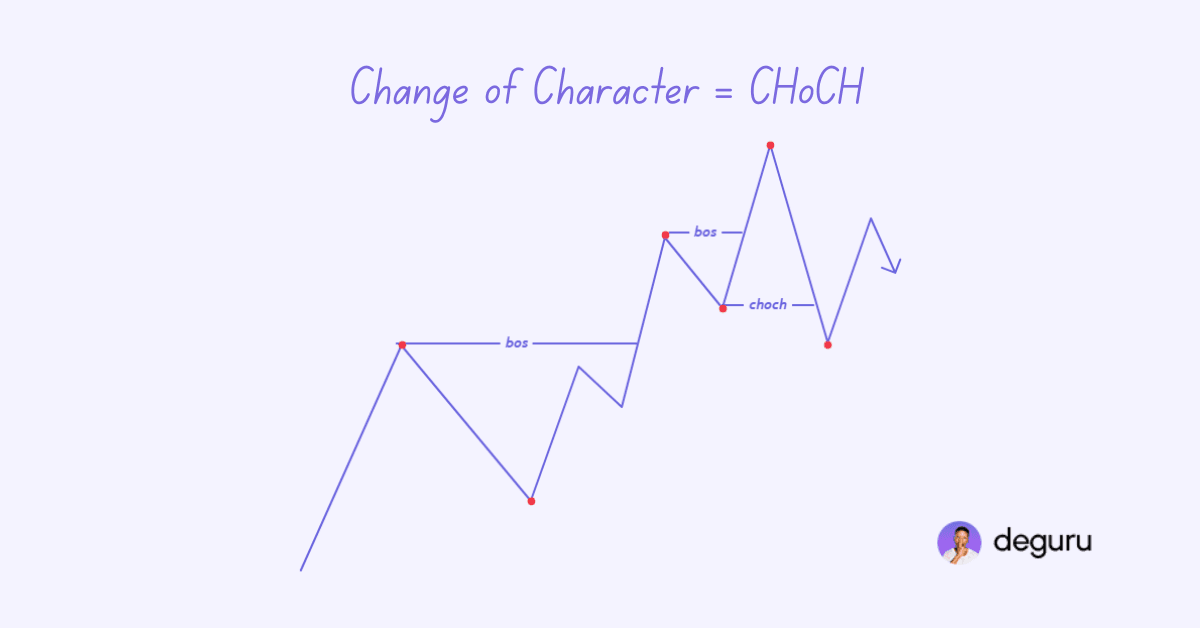

CHoCH (Change of Character)

CHoCH signals a possible trend change.

It happens when the price breaks the structure against the previous trend.

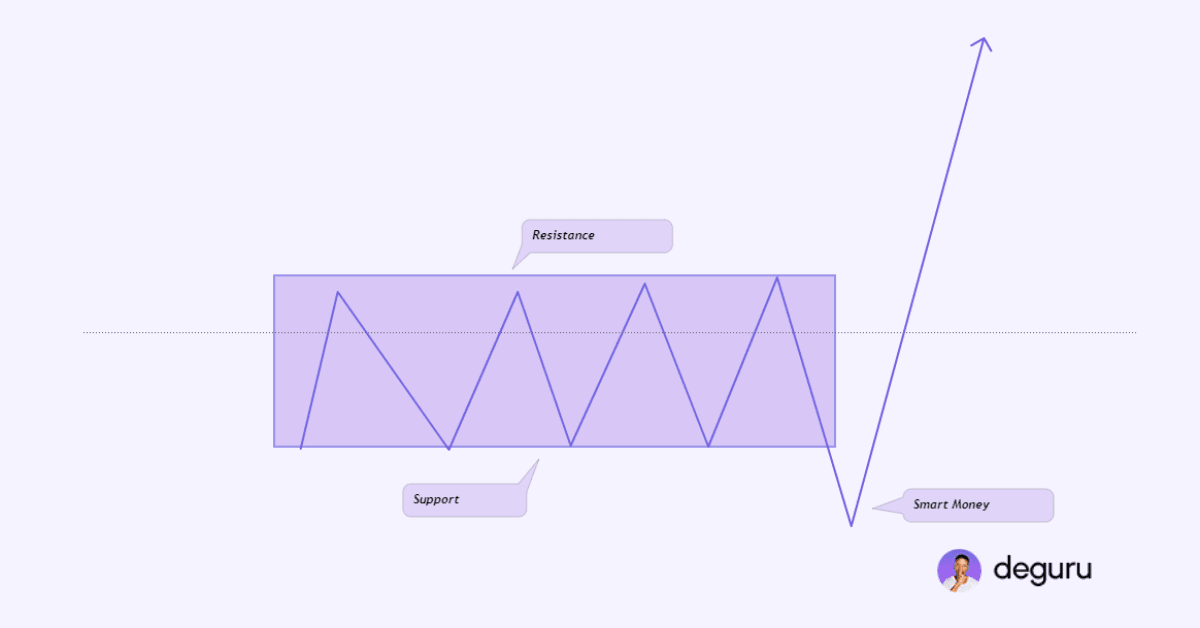

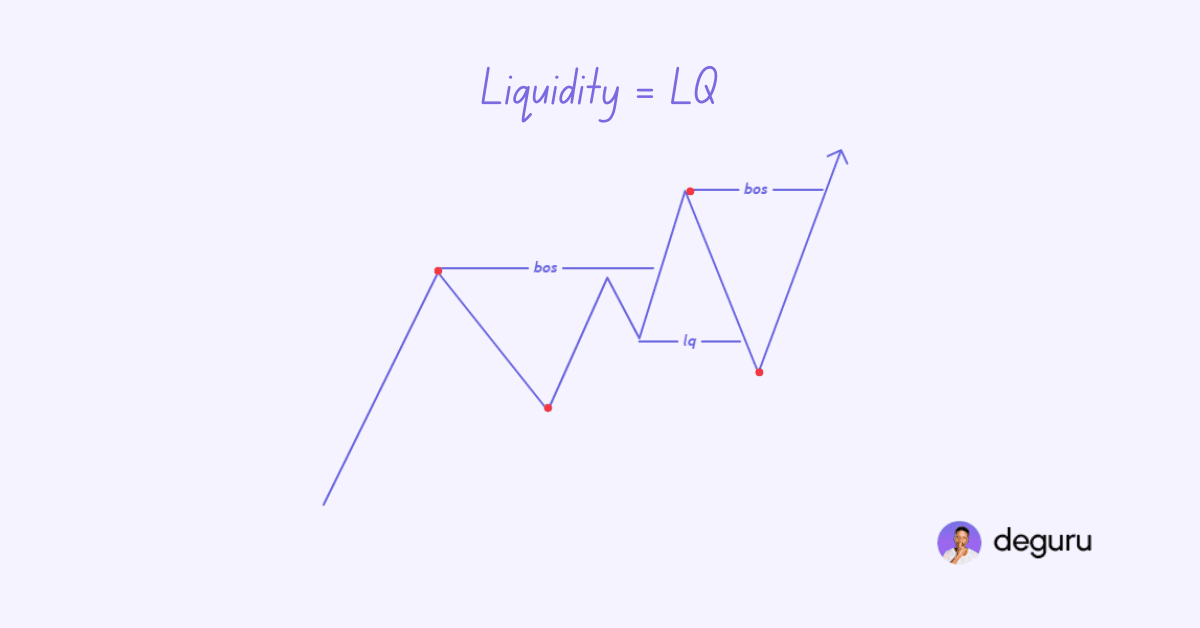

LQ (Liquidity)

Liquidity is where stop losses are resting.

Institutions push prices into these areas to fill large orders/ taking retail out of the market before the big move.

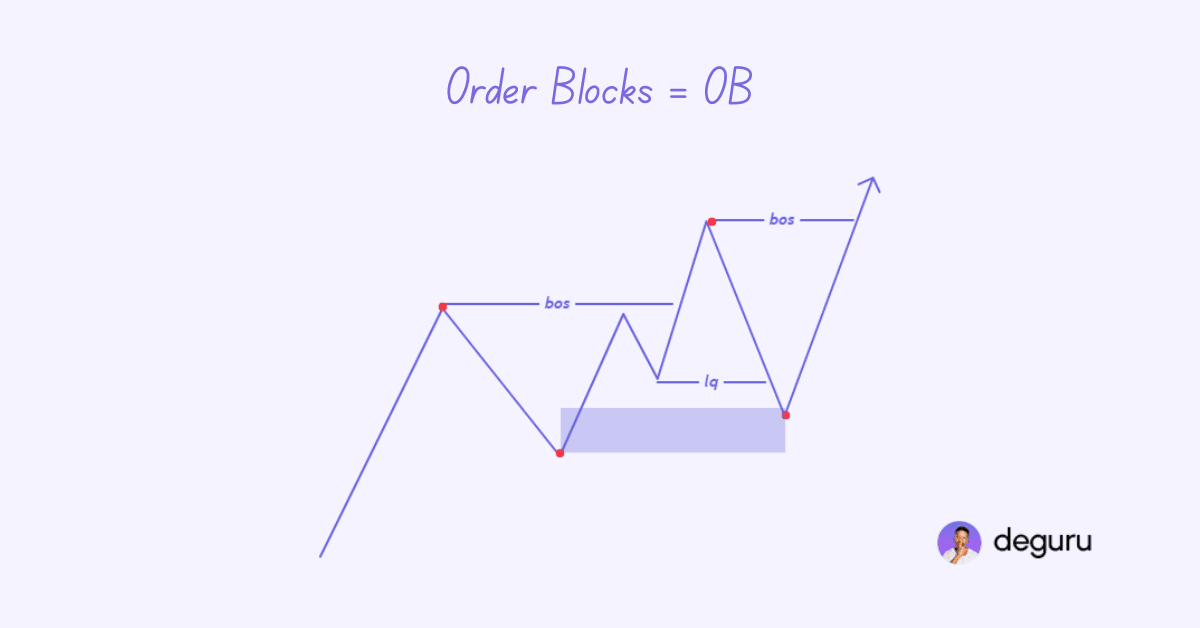

OB (Order Blocks)

Order blocks are areas where institutions placed large buy or sell orders before a strong move.

Price often reacts when it returns to these zones.

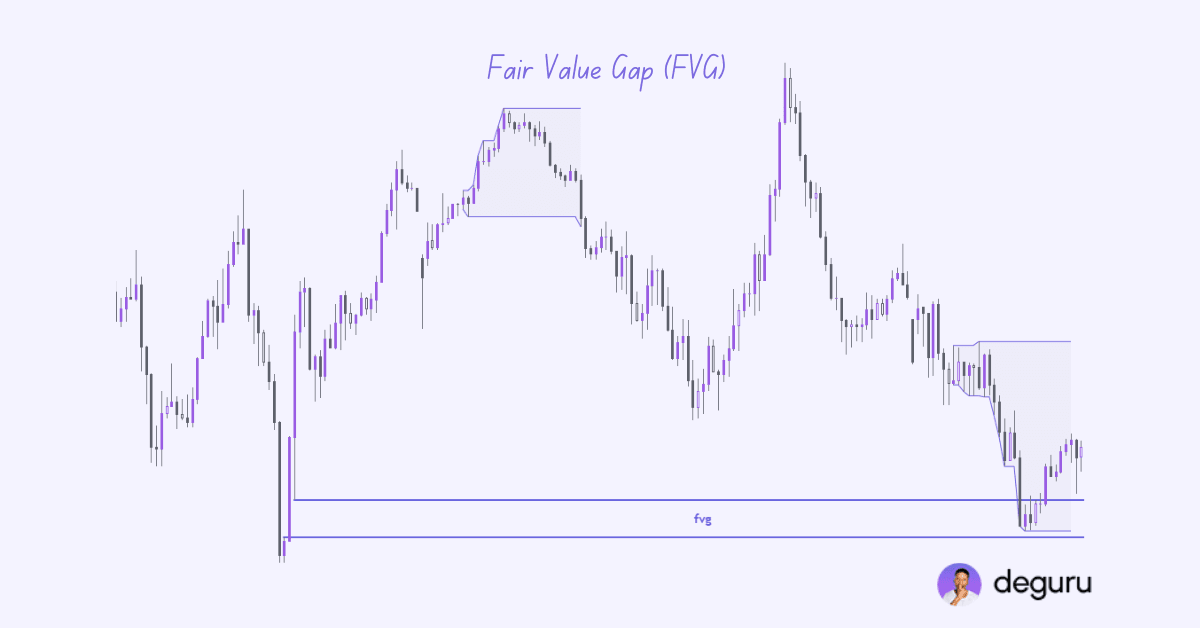

FVG (Fair Value Gap)

A Fair Value Gap is an imbalance created when price moves very fast.

Price often comes back to rebalance these gaps.

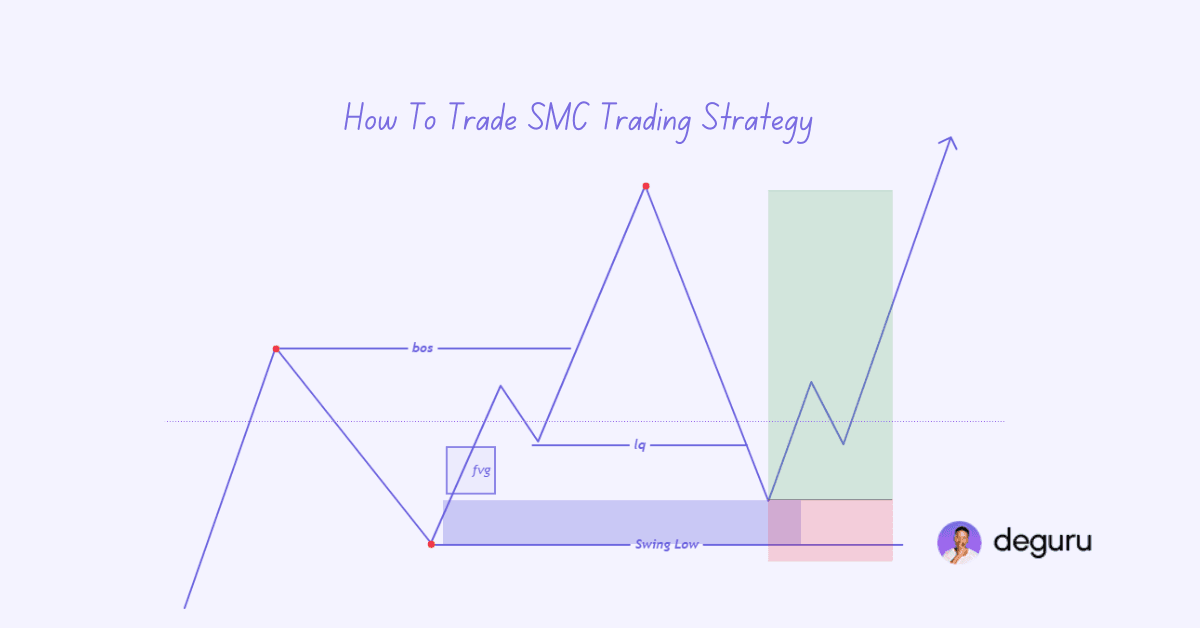

How To Trade SMC Trading Strategy

This is where everything comes together.

Step 1: Higher Timeframe Market Structure

- Use H4

- Identify bullish or bearish structure

You want to align yourself with a high timeframe bias. If you are bullish, you are going to be looking for buying opportunities; if bearish, you are going to be looking for selling opportunities.

Step 2: Medium Timeframe Market Structure

- Use M15

- Identify bullish or bearish structure

If both time frame structures align, you might have a trading opportunity. Otherwise, do nothing.

Step 3: Identify Liquidity

- Mark equal highs/lows

- Previous day high/low

- Trendline liquidity

Wait for price to take liquidity first.

Step 4: Look for CHoCH After Liquidity

Once liquidity is taken:

- Watch for a Change of Character

- This confirms smart money has shifted direction

Step 5: Mark Entry Zones

After CHoCH, look for:

- Order Block

- Fair Value Gap

These are your high-probability entry areas.

Step 6: Enter on Lower Timeframe

Drop to M5 or M1:

- Wait for confirmation

- Enter from OB or FVG

- Stop loss below/above structure

Step 6: Risk Management

- Risk 1–2% per trade

- Aim for 1:3 or higher

- One clean setup is enough

SMC rewards patience, not overtrading.

SMC vs ICT: What’s the Difference

SMC and ICT are very similar.

SMC focuses on execution, not complexity.

Free SMC Trading Course

These are among some of the best free resources available online and good for beginners and intermediate traders wanting structure, liquidity, order blocks, FVG, and entry models explained visually:

YouTuber’s Name | Video | |

|---|---|---|

Final Thoughts

Smart Money Concepts is not magic. It’s simply understanding how the market really moves.

If you:

- Focus on structure

- Wait for liquidity

- Enter from OB or FVG

- Control risk

You give yourself a real chance to succeed.

This Smart Money Concepts Forex Strategy is meant to guide you, not rush you. Take your time. Journal your trades. Master one setup. If you are new to trading, I recommend starting with this beginner’s guide to forex trading.

FAQs

Yes. If explained simply, SMC is one of the best ways for beginners to understand price action.

Higher timeframes for bias, lower timeframes for entries.

Most traders need 3–6 months of proper practice and journaling.

Yes. Smart money principles apply to all markets.

Lack of patience, poor risk management, and rushing entries.

Learn SMC if you are a complete beginner, then you can expand your knowledge to ICT once master SMC