I used to think that if you wanted to buy company shares, you could just walk into that company and ask the CEO to sell you some shares. How crazy that would be to travel to the UK to buy Lloyds Banking shares.

But in 2021, I’ve learned that’s not how it works. If you want to buy UK shares in South Africa, you need to go through a stockbroker. A stockbroker is a platform or a company that helps you buy and sell shares easily and safely.

My name is Thabiso, a South African forex trader since 2020, also started investing in stocks. In this article, I will give you all you need to know to start buying UK shares on the LSE.

What is LSE

LSE stands for the London Stock Exchange, a marketplace where United Kingdom-registered companies list their shares for the public to buy. It is one of the biggest stock markets in the world.

The process when a company gets listed on the LSE is called IPO (Initial Public Offering).

Here is the list of LSE Alternatives.

Country | Exchange Name | Exchange Code | |

|---|---|---|---|

United States | Newyork Stock Exchange | NYSE | |

South Africa | Johannesburg Stock Exchange | JSE | |

Australia | Australian Securities Exchange | ASX | |

Japan | Tokyo Stock Exchange | TSE |

In order to buy UK shares on LSE in South Africa, you must register with a stockbroker that offers LSE shares. For example, (EasyEquities) then search for the company you want to buy shares in.

Here is a step-by-step guide to buying shares in South Africa.

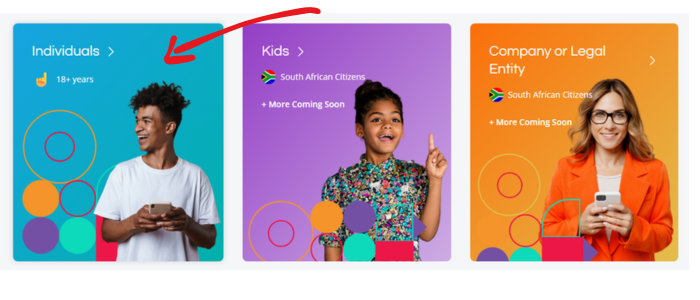

Step 1: Create an Account With EasyEquity

First things first, you need a stockbroker who will be the middleman between you and the company. EasyEquities is one of the best stockbrokers, easy to use and great for newbies. Here’s what to do:

- Visit the EasyEquities Website or App

- Click “Register” and fill in your details: name, email, ID number, and a password.

- Verify Your Account: You’ll need to submit some documents (like your ID and proof of address) to comply with South Africa’s FICA regulations. Don’t worry, it’s quick and secure.

- Once verified (usually within a day or two), you’re ready to invest!

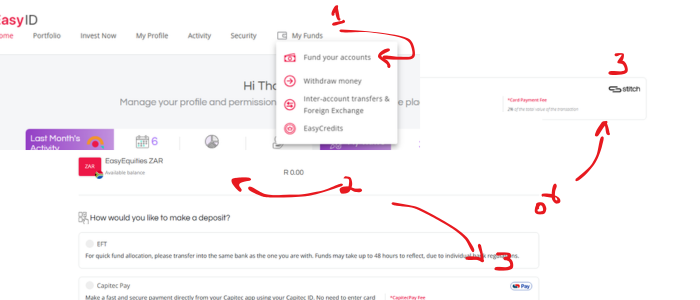

Step 2: Deposit Money on EasyEquity

Now that your account is set up, it’s time to add some cash to start buying shares. There are, best banks for traders or investors that you can switch to if you are serious about investing.

- Log in to your EasyEquities account.

- Choose “Deposit Funds.”

- Transfer money from your bank account (EFT or card payments work).

I recommend using Stitch (FET) or Capitec Pay so that your funds will reflect instantly.

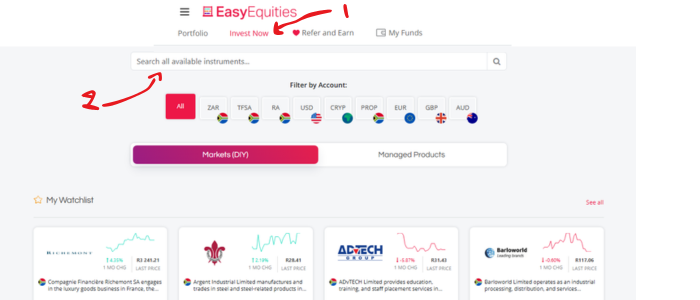

Time to become a shareholder! Here’s how to buy your first shares.

- Use the search bar to find a company you like (e.g., “Barclays ” or “Lloyds Banking ”).

- Enter the amount of money you want to invest. (EasyEquities allows you to buy fractional shares, meaning you can invest with as little as R10)

- Confirm your purchase.

Congratulations 🎉 You now officially own shares in a UK company.

While EasyEquities is the easiest for beginners, there are other alternative brokers you can use, like Shayft and BrokStock.

Brokers | Rating | Exchanges | Fees | Fractional Shares |

|---|---|---|---|---|

| ★ 4.9/5 | JSE, US Stocks, ETFs, Bundles, RA, TFSA | 0.25% | |

| ★ 4.7/5 | JSE, US Stocks, Global ETFs | 0.40% | |

| ★ 4.6/5 | JSE, US, UK, EU, Asia-Pacific Stocks | 0.10% |

Conclustion

Investing in UK stocks in South Africa is much easier than it seems. You don’t need to be rich or experienced. Check out our guide to investing in stocks for beginners if you want to learn more.