Buying stocks requires a stockbroker; just like choosing a bank, you need to look for a reliable one based on fees, reliability, tools, and simplicity.

In this EasyEquities Review, we break down everything you need to know about EasyEquities including the pros, cons, costs, safety, customer support, fees, and who this platform is best suited for.

My name is Thabiso aka deguru, a South African forex trader since 2020, also started investing in stocks.

What is EasyEquities?

EasyEquities is an online investment platform that allows users to buy shares, ETFs, and other assets using small amounts of money. It focuses on long-term investing rather than short-term trading.

The company is owned by Purple Group, which is listed on the Johannesburg Stock Exchange. This adds transparency and accountability.

EasyEquities operates mainly in South Africa but also allows access to international markets such as the US, Europe, the UK, and Australia.

Is EasyEqueties Regulated: Yes, here are the licenses

The main idea behind EasyEquities is simple:

Make investing affordable, understandable, and accessible to everyone.

EasyEqueties Pros & Cons

In short, EasyEquities performs best for beginners and long-term investors, not for advanced or high-frequency traders.

EasyEquities Review | Offered Features

EasyEquities offers a wide range of features designed for everyday investors.

Some of the main features include:

These features make EasyEquities more than just a basic stock-buying app.

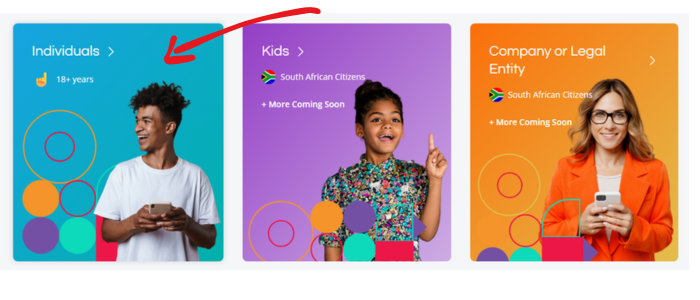

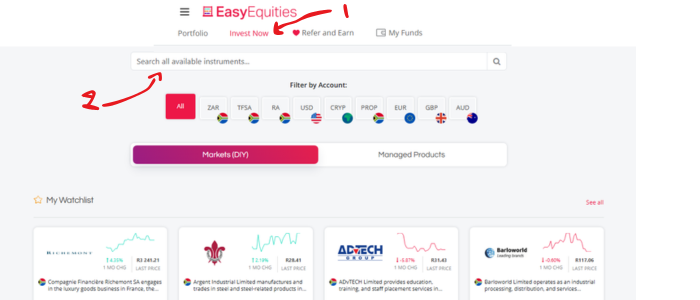

Account Types Available on EasyEquities

EasyEquities offers many different account types to suit different goals.

ZAR Account

The ZAR account is the standard local account.

It allows you to:

- Buy JSE-listed shares

- Invest in local ETFs

- Use South African Rand

This is the most common account for beginners.

Tax-Free Savings Account (TFSA)

The TFSA allows you to invest without paying tax on:

- Dividends

- Capital gains

This account is ideal for long-term savings and retirement planning.

USD Account

The USD account allows you to invest in:

- US stocks

- US ETFs

This gives South Africans easy access to companies like Apple, Microsoft, and Google.

AUD, GBP, EUR Accounts (Offshore / Global Accounts)

These accounts allow investment in:

- European markets

- UK markets

- Australian markets

They are useful for diversification outside the US.

Retirement & Long-Term Savings Accounts (RA, Preservation / Provident Funds)

EasyEquities also offers retirement products such as:

- Retirement Annuities (RA)

- Preservation funds

These accounts are designed for long-term financial planning.

Other Investment Accounts (Property & Crypto)

You can gain exposure to:

- Property-related investments

- Cryptocurrency

These accounts are simpler than dedicated crypto exchanges but are suitable for beginners.

Demo Accounts (ZAR & USD)

Demo accounts allow you to:

- Practice investing

- Learn how the platform works

- Test strategies without real money

This is very useful for beginners.

You can open multiple accounts under one profile, including local, offshore, tax-free, and retirement accounts.

Is EasyEquities Safe

Yes, EasyEquities takes safety seriously and operates under South African financial regulations.

Safety is one of the most important questions when choosing an investment platform. You want to know that your money and investments are protected

EasyEquities uses several protection measures:

This means EasyEquities cannot use your money for its own business activities.

Fractional shares are structured so that:

- You still have a claim to the underlying asset

- Shares are held through approved custodians

- Your ownership is recorded even if the platform fails

While no investment is completely risk-free, fractional shares on EasyEquities are designed to protect investor ownership as much as possible.

In order to buy shares on the EasyEquities, you must register them. Then search for the company you want to buy shares in. Here is a step-by-step guide:

Step 1: Create an Account With EasyEquity

- Visit the EasyEquities Website or App

- Click “Register” and fill in your details: name, email, ID number, and a password.

- Verify Your Account: You’ll need to submit some documents (like your ID and proof of address) to comply with South Africa’s FICA regulations. Don’t worry, it’s quick and secure.

- Once verified (usually within a day or two), you’re ready to invest!

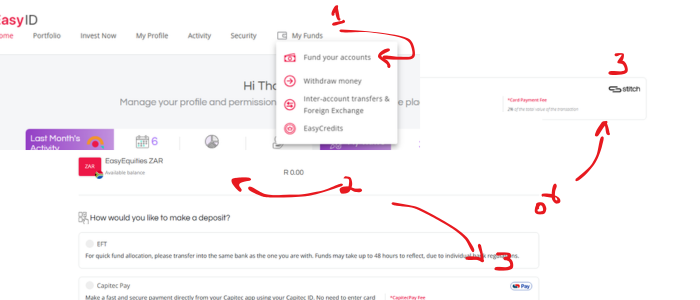

Step 2: Deposit Money on EasyEquity

Now that your account is set up, it’s time to add some cash to start buying shares. There are, best banks for traders or investors that you can switch to if you are serious about investing.

- Log in to your EasyEquities account.

- Choose “Deposit Funds.”

- Transfer money from your bank account (EFT or card payments work).

- There is no minimum deposit with EasyEqueties

I recommend using Stitch (FET) or Capitec Pay so that your funds will reflect instantly.

Time to become a shareholder! Here’s how to buy your first shares.

- Use the search bar to find a JSE-listed company you like (e.g., “Shoprite” or “Capitec”).

- Enter the amount of money you want to invest. (EasyEquities allows you to buy fractional shares, meaning you can invest with as little as R10)

- Confirm your purchase.

Congratulations 🎉 You now officially own shares.

EasyEquities Cost and Fees

One of the biggest reasons people choose EasyEquities is low and transparent fees. However, there are still costs involved, and understanding them helps avoid surprises.

EasyEquities does not charge a flat monthly platform fee for most users, but certain fees apply depending on how you use the platform.

ZAR Account | USD Account | AUD Account | GBP Account | EUR Account | |

|---|---|---|---|---|---|

Broker Commission | 0.25% | 0.25% | 0.25% | 0.25% | 0.25% |

Clearing & Admin Fees | 0.0795% | 0.31% | 0.31% | 0.31% | 0.31% |

EFT Deposit Fee | Free | Free | Free | Free | Free |

Minimum First Deposit | N/A | N/A | N/A | N/A | N/A |

Foreign Exchange Fee | 0.5% | 0.5% | 0.5% | 0.5% | 0.5% |

Withdrawal Fee | N/A | N/A | N/A | N/A | N/A |

Clearing & Admin Fees

The Clearing & Administration Charges (sometimes called Settlement and Administration) are fees related to the processing of your trades. This covers the clearing, settlement, and administration of your buy and sell transactions, including the Fractional Security Rights portion where applicable.

The rates for these fees vary depending on the account type:

- ZAR & TFSA Accounts: 0.0795% of the value traded.

- USD, GBP, EUR, and AUS Accounts: 0.31% of the value traded for both buying and selling.

Broker Commission (Buy/Sell)

Yes, you are charged a broker commission both when you buy and when you sell assets. This commission is calculated as a percentage of the total value of each transaction you enter into on the platform.

The standard commission rate across most accounts (ZAR, TFSA, USD, GBP, EUR, and AUS) is 0.25% (or 25 basis points).

EasyEquities Deposit and Withdrawal

EasyEquities offers several ways to fund your account. While EasyEquities itself does not charge for many of these methods, third-party providers (like banks or payment gateways) often do.

Deposit Method | Deposit Types Offered | Fee | |

|---|---|---|---|

Direct EFT | Manual Bank Transfer | N/A | |

Stitch (Instant EFT) | Master Card, Visa, Google Pay, Apple Pay | 2% | |

Adumo (Instant EFT) | Master Card & Visa | 2.2% +R1.60 | |

Capitec Pay | Capitec Bank | R1 |

Minimum Deposit: There is no minimum first deposit requirement for any of the accounts

Portfolio Transfers Out Off EasyEqueties: If you decide to move your actual shares (instead of just cash) to another broker, you will be charged per counter (per different share held):

- ZAR/TFSA: R150 per counter.

- USD: $25 per counter.

- UK (GBP): £20 per counter.

- EUR: €20 per counter.

- AUS: AUD25 per counter

Conclusion

EasyEquities is one of the best platforms for beginner and long-term investors in South Africa. It is not perfect, but it has helped many people start their investing journey.

If you also want to start your journey, here is a beginner’s guide to investing in stocks in South Africa.

FAQs

It is an online platform for buying shares and ETFs with small amounts of money.

Shares, ETFs, crypto, property products, and more.

They are structured to protect ownership, though all investing carries risk.

Yes, via USD, EUR, GBP, and AUD accounts.

Yes, it is regulated by the FSCA.