I used to think that if you wanted to buy company shares, you could just walk into that company and ask the CEO to sell you some shares.

But I’ve since learned that’s not how it works. If you want to buy shares in South Africa in any JSE-listed company, you need to go through a stockbroker. A stockbroker is a platform or a company that helps you buy and sell shares easily and safely.

My name is Thabiso, a South African forex trader since 2020, also started investing in stocks. In this article, I will give you all you need to know to start investing in stocks, aka buying shares.

What is a stock exchange?

The stock exchange is a marketplace where companies list their shares for the public to buy. The process is called IPO (Initial Public Offering).

Here is the list of stock exchanges

Country | Exchange Name | Exchange Code | |

|---|---|---|---|

South Africa | Johannesburg Stock Exchange | JSE | |

United States | New York Stock Exchange | NYSE | |

United Kingdom | London Stock Exchange | LSE | |

Australia | Australian Securities Exchange | ASX | |

Japan | Tokyo Stock Exchange | TSE |

But you can not just go to the exchange and ask to buy shares, you need a middleman (Stockbroker).

- Stock: Is a general ownership you have in a company

- Share: A single ownership in one company

When you say you own 3 stocks, that means you have ownership in 3 different companies. But if you say you own 3 shares, that means you have 3 units worth of a single company.

In order to buy shares in South Africa, you must register with a stockbroker ( EasyEquities), for example then search for the company you want to buy shares in.

Here is a step-by-step guide to buying shares in South Africa.

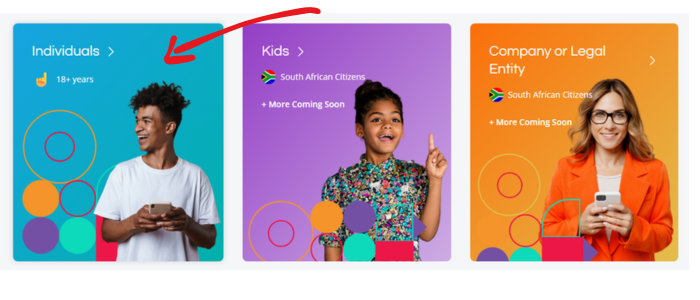

Step 1: Create an Account With EasyEquity

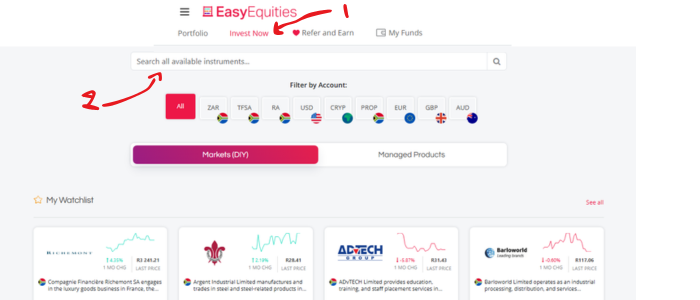

First things first, you need a stockbroker who will be the middleman between you and the company. EasyEquities is one of the best stockbrokers, easy to use and great for newbies. Here’s what to do:

- Visit the EasyEquities Website or App

- Click “Register” and fill in your details: name, email, ID number, and a password.

- Verify Your Account: You’ll need to submit some documents (like your ID and proof of address) to comply with South Africa’s FICA regulations. Don’t worry, it’s quick and secure.

- Once verified (usually within a day or two), you’re ready to invest!

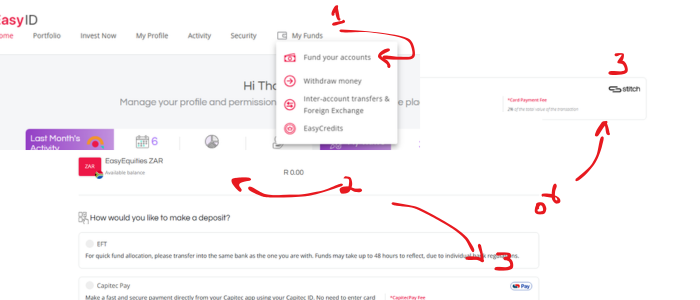

Step 2: Deposit Money on EasyEquity

Now that your account is set up, it’s time to add some cash to start buying shares. There are, best banks for traders or investors that you can switch to if you are serious about investing.

- Log in to your EasyEquities account.

- Choose “Deposit Funds.”

- Transfer money from your bank account (EFT or card payments work).

I recommend using Stitch (FET) or Capitec Pay so that your funds will reflect instantly.

Time to become a shareholder! Here’s how to buy your first shares.

- Use the search bar to find a company you like (e.g., “Shoprite” or “Anglo American”).

- Enter the amount of money you want to invest. (EasyEquities allows you to buy fractional shares, meaning you can invest with as little as R10)

- Confirm your purchase.

Congratulations 🎉 You now officially own shares in a South African company.

EasyEquities Alternative

While EasyEquities is the easiest for beginners, there are other alternative brokers you can use, like Shayft, BrokStock, SatrixNOW, and Webull.

Brokers | Rating | Exchanges | Fees | Fractional Shares |

|---|---|---|---|---|

| ★ 4.9/5 | JSE, US Stocks, ETFs, Bundles, RA, TFSA | 0.25% | |

| ★ 4.7/5 | JSE, US Stocks, Global ETFs | 0.40% | |

| ★ 4.6/5 | JSE, US, UK, EU, Asia-Pacific Stocks | 0.10% | |

| ★ 4.2/5 | JSE, Local & Global ETFs | 0.075% | |

| ★ 3.9/5 | US Stocks, ETFs, Options | R4,50 |

Conclustion

Buying shares in South Africa is much easier than it seems. You don’t need to be rich or experienced. All you need is:

- A broker account (like EasyEquities).

- Money to deposit.

- The willingness to start small and grow.

If you follow the simple steps above, you’ll be on your way to building wealth through the stock market.

FAQs

With EasyEquities, you can start with as little as R10 thanks to fractional shares.

Yes, foreign investors can buy JSE-listed shares through registered brokers.

You can’t walk into a company and buy shares directly from the CEO or head office. To buy company shares in South Africa, you must go through a stockbroker like EasyEquities.