I have seen a lot of “Investing in stocks for beginners” guides that were not really beginner-friendly😁. They use a lot of investing jargon that honestly made me feel overwhelmed. This is not one of those.

I remember staring at a list of stocks, unfamiliar terms, and endless opinions online about which is the best stock, wondering if I was already too late to start investing or about to make an expensive mistake.

My name is Thabiso aka deguru, a South African forex trader since 2020, also started investing in stocks. In this article, I will give you all you need to know to start investing in stocks. Well, buying shares.”potato, potahto”😂

It might seem like there is no difference between stocks and shares, but there is.

When you say you own 3 stocks, that means you have ownership in 3 different companies. But if you say you own 3 shares, that means you have 3 units worth of a single company. Simple right?

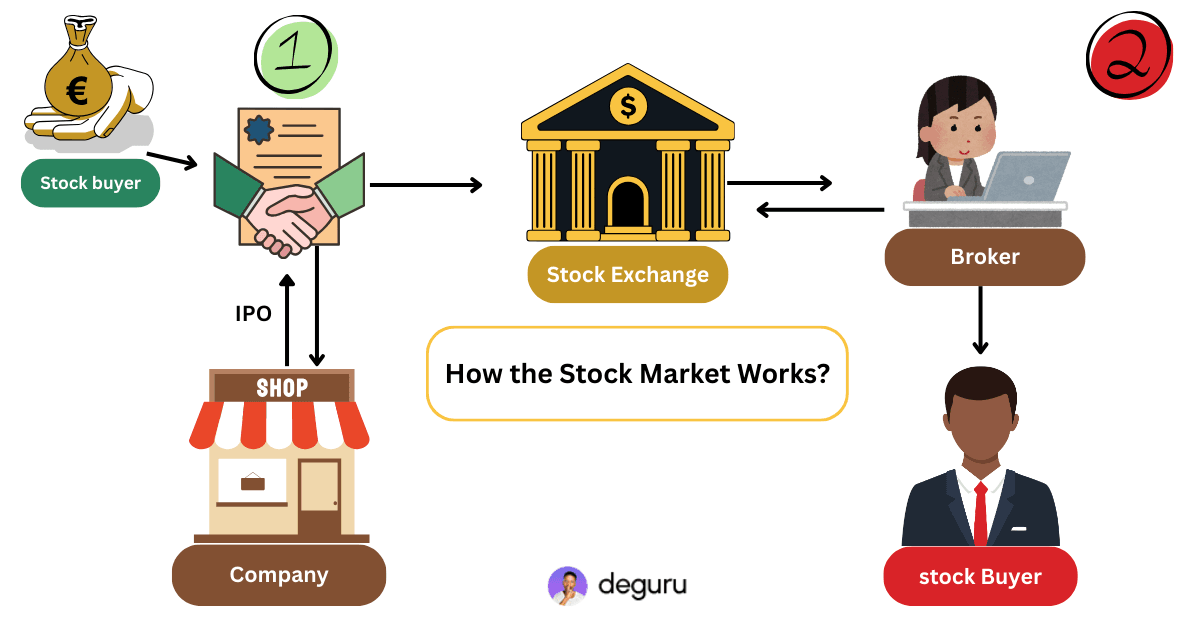

How the Stock Market Works

The stock market is simply a marketplace to buy and sell stocks; think of it like the Facebook marketplace. I list a phone on Facebook Marketplace for $100 then you buy it and list it yourself for $150. When someone buys it, you make $50 profit.

This process begins with a company that wants to raise funds, maybe to expand its business.

Shares are sold to the public, traded on the exchange through a stockbroker, then shares are stored in a central registry. And brokers only give you proof of ownership.

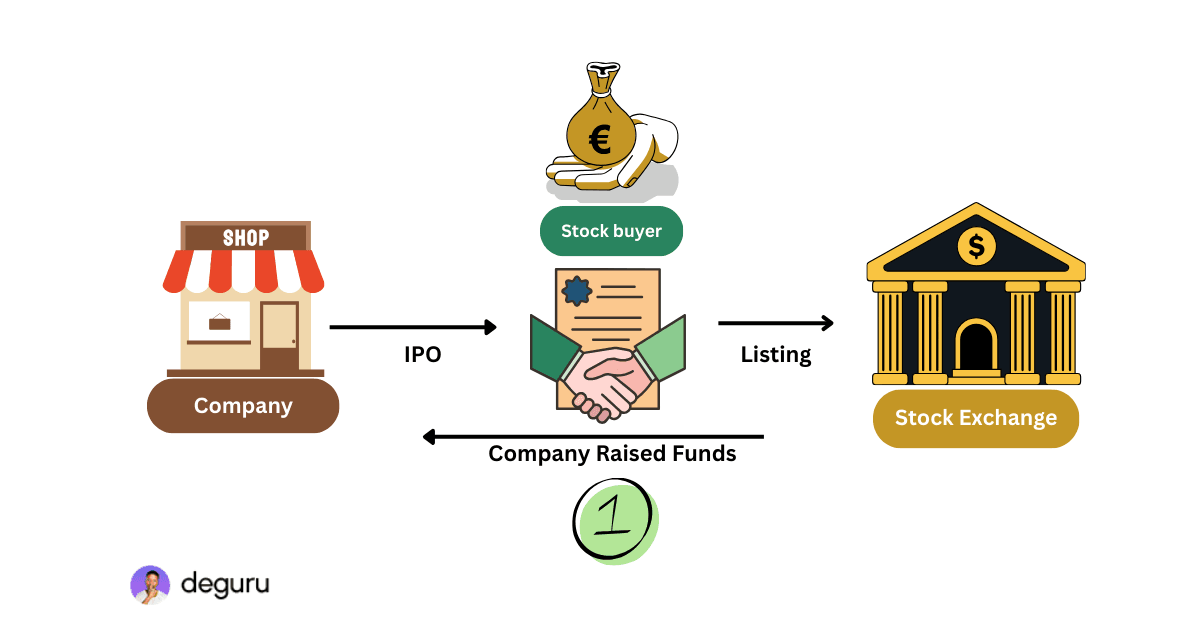

What is IPO

An IPO is short for (Initial Public Offering). It is when a private company becomes public and allows everyday investors like you and me to buy shares of the company for the first time.

During an IPO, the company creates new shares and sells them to investors.

The money paid for those shares goes directly to the company, which it uses to grow the business, pay debt, or expand operations. However, popular IPOs may be limited or allocated mainly to large investors.

What is the Stock Exchange

A stock exchange is a regulated marketplace where companies list their shares for buying and selling through a licensed stockbroker.

List of popular stock exchanges in the world

Country | Exchange Name | Exchange Code | |

|---|---|---|---|

United States | New York Stock Exchange | NYSE | |

United Kingdom | London Stock Exchange | LSE | |

Australia | Australian Securities Exchange | ASX | |

Japan | Tokyo Stock Exchange | TSE | |

South Africa | Johannesburg Stock Exchange | JSE |

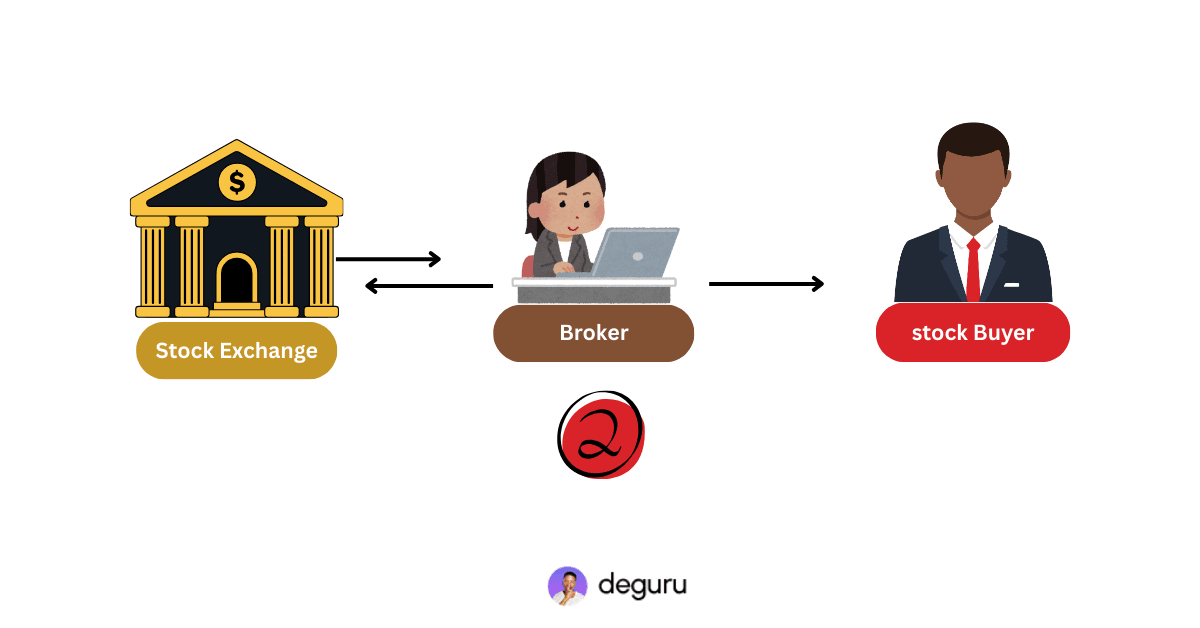

What is a Stockbroker

A stockbroker is a licensed financial service provider that buys and sells shares on your behalf by placing your orders on the stock exchange.

Brokers provide the tools, regulated access (to different exchanges), accounts, and technology that let everyday investors participate in markets.

Here is a list of the best stockbrokers in Africa, Asia, Europe, and America

Broker Name | Countries | Fractional Shares | |

|---|---|---|---|

EasyEquities | South Africa | ||

Interactive Brokers (IBKR) | Global / Multi-Region | ||

Charles Schwab | USA | ||

Wealthsimple | Canada | ||

Trading 212 | United Kingdom | ||

Trade Republic Bank | Germany, Spain, Italy | ||

Saxo Bank | Sweden, Norway, Denmark | ||

Stake | Australia | ||

Tiger Brokers | Singapore | ||

Rakuten Securities | Japan | ||

Bamboo | Nigeria |

Investing In Stocks For Beginners Guide

There are 3 things you need to start investing in stocks: 1. a brokerage account, 2. $10 minimum of money, 3. The stocks you want to buy.

I have seen a lot of articles saying “define your investing goals,” it’s stupid😂. My goal is to make money, I’m sure yours too it’s to make money.

Open a Broker Account

A stockbroker is a gateway; there is no way to invest with it. if you are in South Africa hare is a guide” buy shares in South Africa“.

Once your account is ready, you can start buying stocks.

How To Find The Best Stocks

Ask yourself this one question:” What are the things we can not live without and we have been spending money on, for the past 20 years?” Simple right? Those are the best stocks to buy for beginners.

Sector | What they do | Famous Examples | |

|---|---|---|---|

Information Technology | Software, hardware, and semiconductors. | Apple, Microsoft, Nvidia | |

Health Care | Hospitals, drug makers (pharma), and medical devices. | Pfizer, Johnson & Johnson | |

Financials | Banks, insurance companies, and credit cards. | JPMorgan, Visa, Goldman Sachs | |

Consumer Discretionary | “Wants” – items you buy when you have extra cash. | Amazon, Tesla, Starbucks, Nike | |

Consumer Staples | “Needs” – essentials like food, soap, and toilet paper. | Walmart, Coca-Cola, PepsiCo | |

Communication Services | Social media, internet providers, and entertainment. | Google (Alphabet), Meta, Disney | |

Energy | Oil, natural gas, and coal. | ExxonMobil, Chevron, Shell | |

Industrials | Construction, aerospace, airlines, and machinery. | Boeing, Caterpillar, Delta Airlines | |

Utilities | Electricity, water, and gas delivery to homes. | NextEra Energy, Duke Energy | |

Materials | Mining, chemicals, paper, and steel. | Sherwin-Williams, Dow, Newmont | |

Real Estate | Companies that own malls, offices, or cell towers. | American Tower, Simon Property Group |

From all these sectors, the main 3 every beginner must focus on are Healthcare, Utilities, and Consumer Staples.

Even in a recession, natural disasters, or even war, people still need medicine, electricity, and groceries. These stocks tend to stay steady when the market crashes.

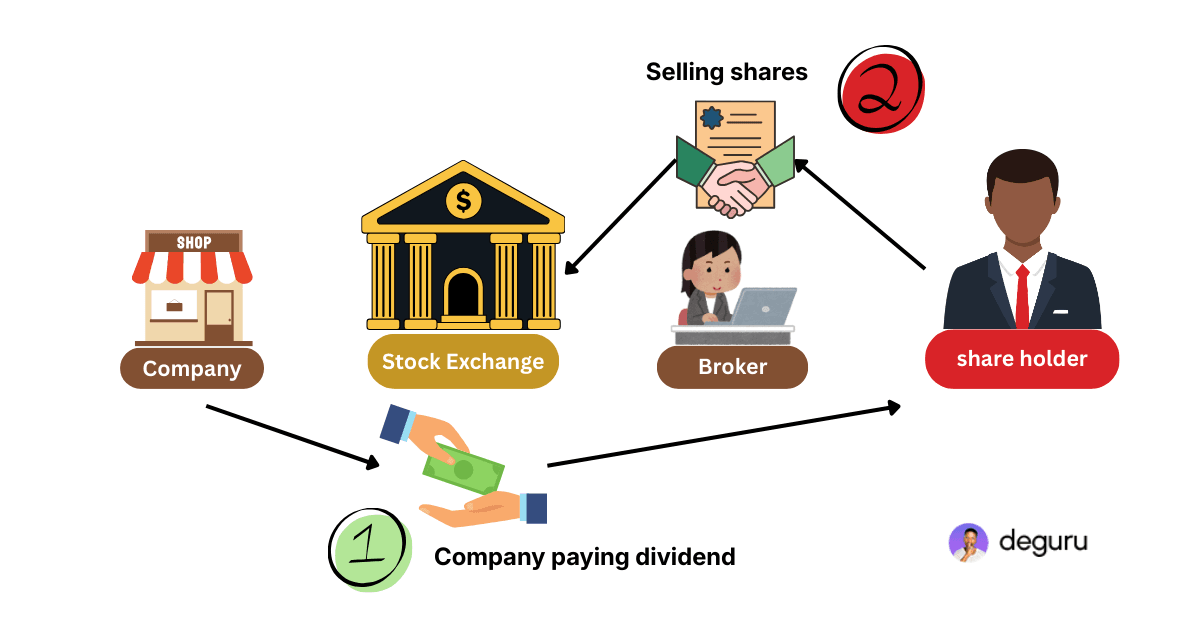

How To Make Money Buying Stocks

There are two ways to make money buying stocks: 1. Capital gain, 2. Dividends. Let me explain what dividends and capital gains are.

The goal of every investor is not to sell but to earn enough dividends to cover their monthly living expenses, which is basically passive income. But most companies pay dividends quarterly (4 times a year), not monthly.

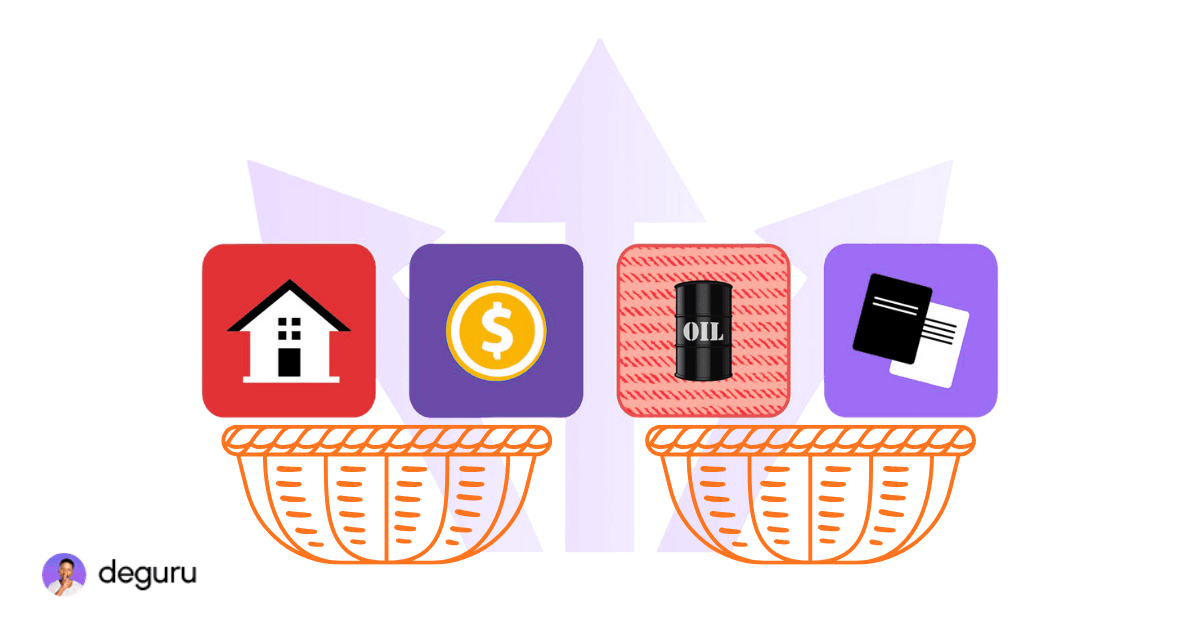

Building An Investment Portfolio For Beginners

An investment portfolio is all the investments you own, put together in one place. This process is very important.

Imagine you put all your water in one bucket and it cracks, you lose everything but if you had 2 buckets 1 cracks, you can survive with 1 until the rain comes.

🟢 Stocks

Stock is the ownership of a company. They grow faster than most assets, but prices move up and down.

Best for:

Example sectors:

🔵 ETFs

An ETF is an investment that holds many assets inside one fund, like stocks, bonds. ETFs give you instant diversification.

You can buy:

Why beginners love ETFs:

🟣 Crypto ETFs

A crypto ETF lets you invest in cryptocurrencies without owning the coins directly.

Important rules:

🟠 Bonds

A bond is basically a loan you give to a government or company.

They:

Good for:

🟡 Savings Accounts

A savings account is where you keep money you might need quickly.

Purpose:

Rule:

🔴 Pension Funds/ Provident/401(k) Funds

Retirement funds are specialized investment vehicles designed to help you accumulate wealth during your working years so that you have a reliable source of income once you stop working.

They:

Perfect for:

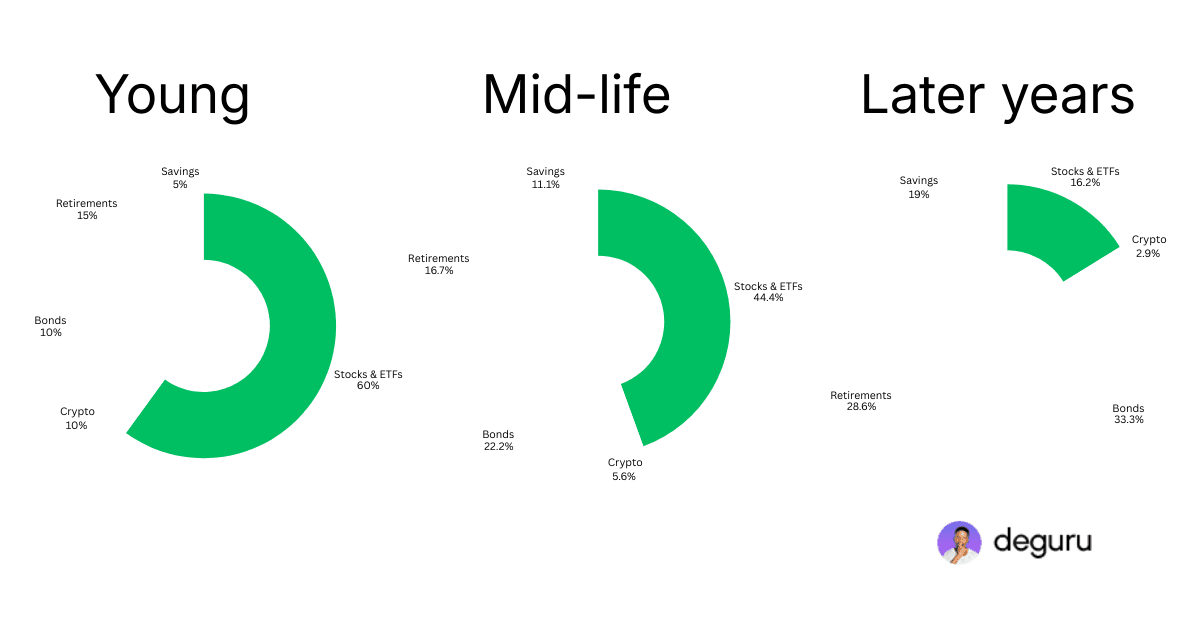

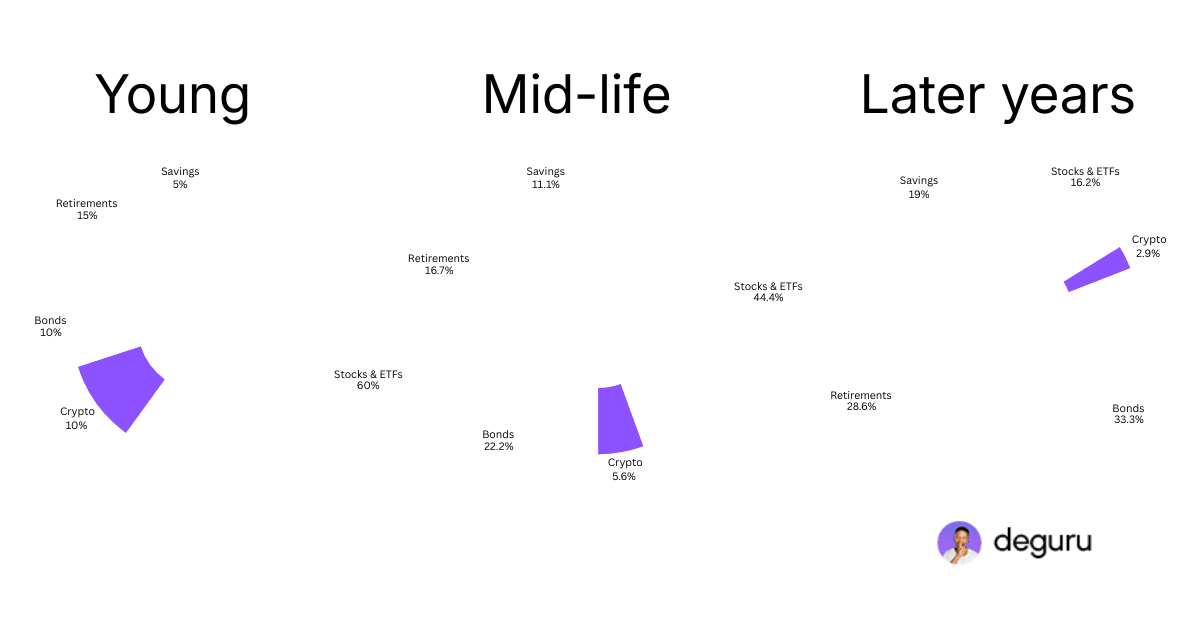

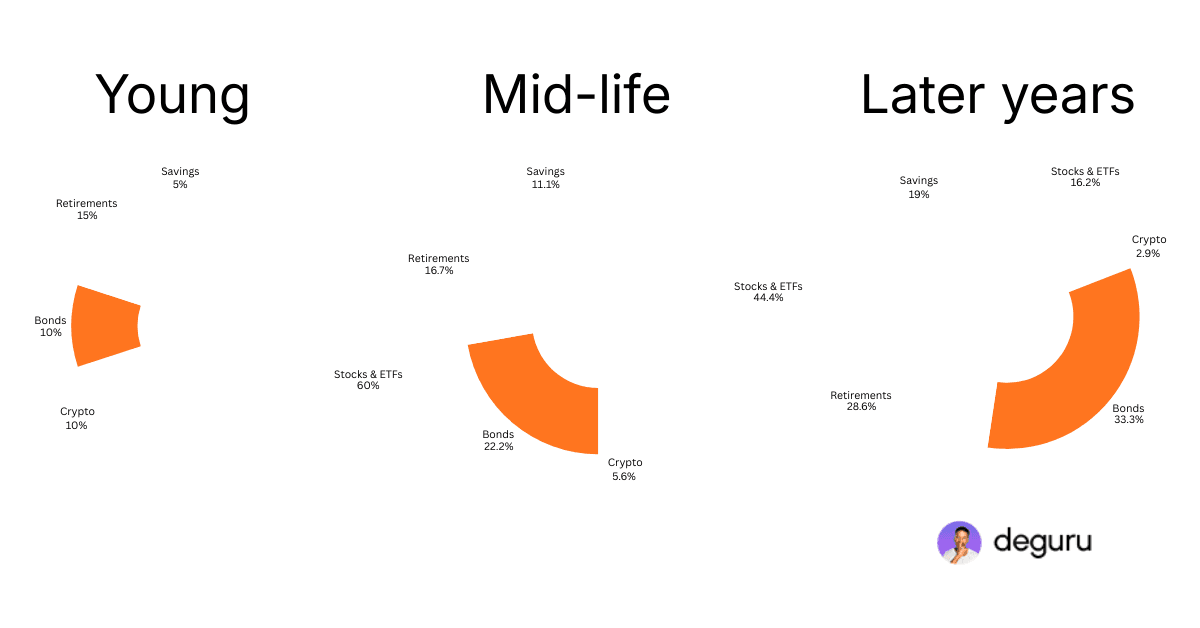

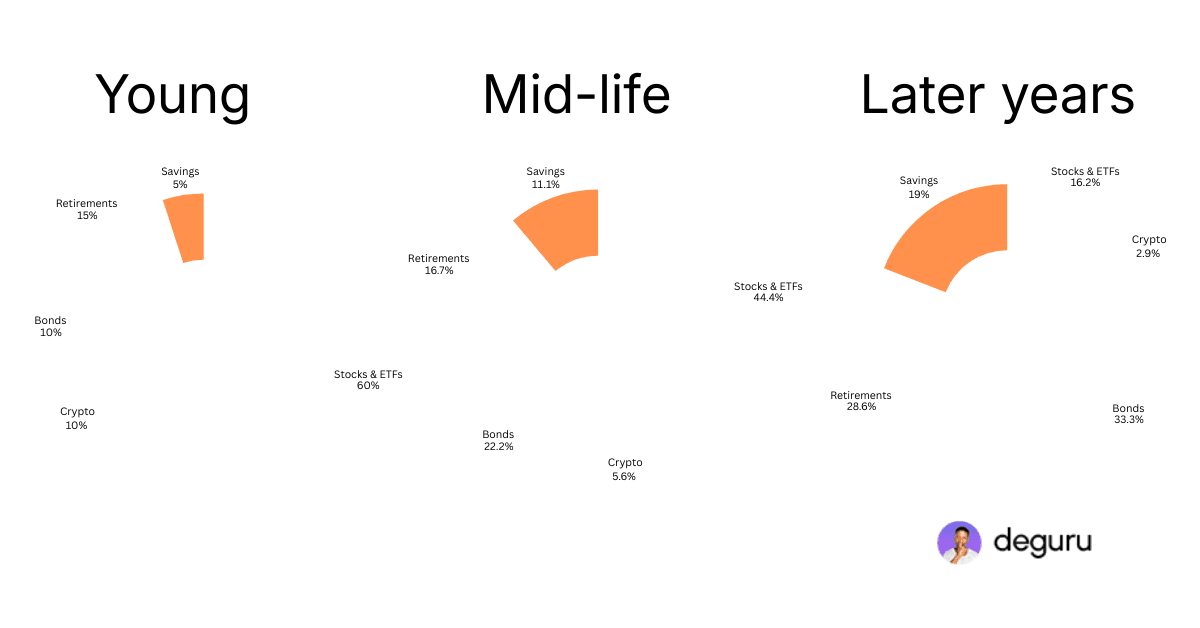

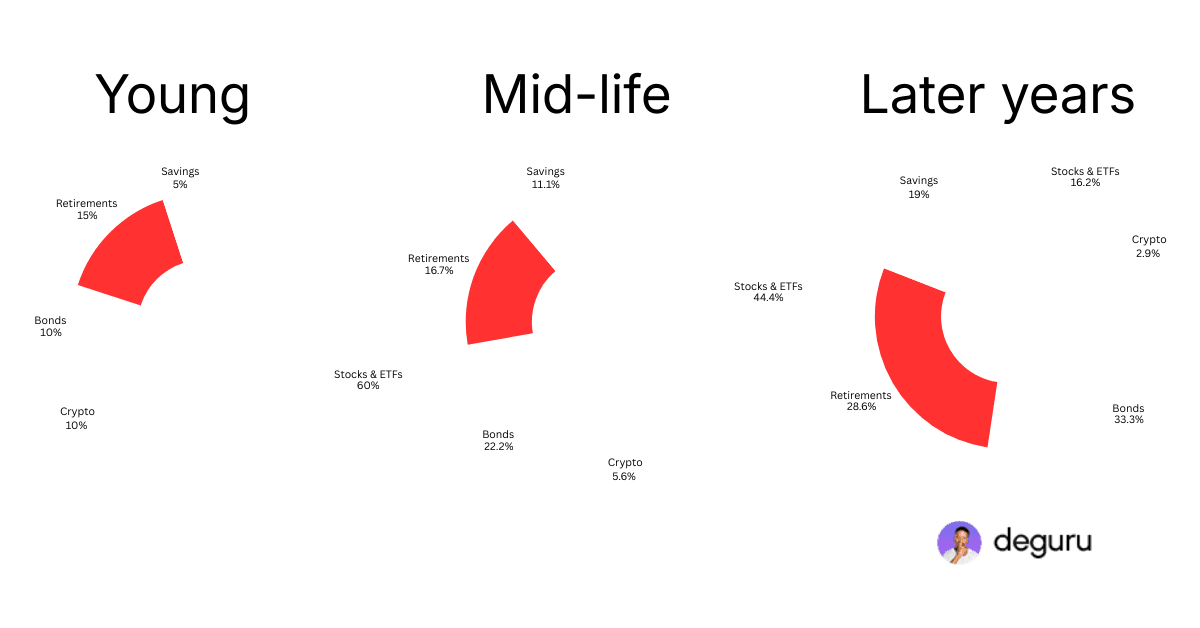

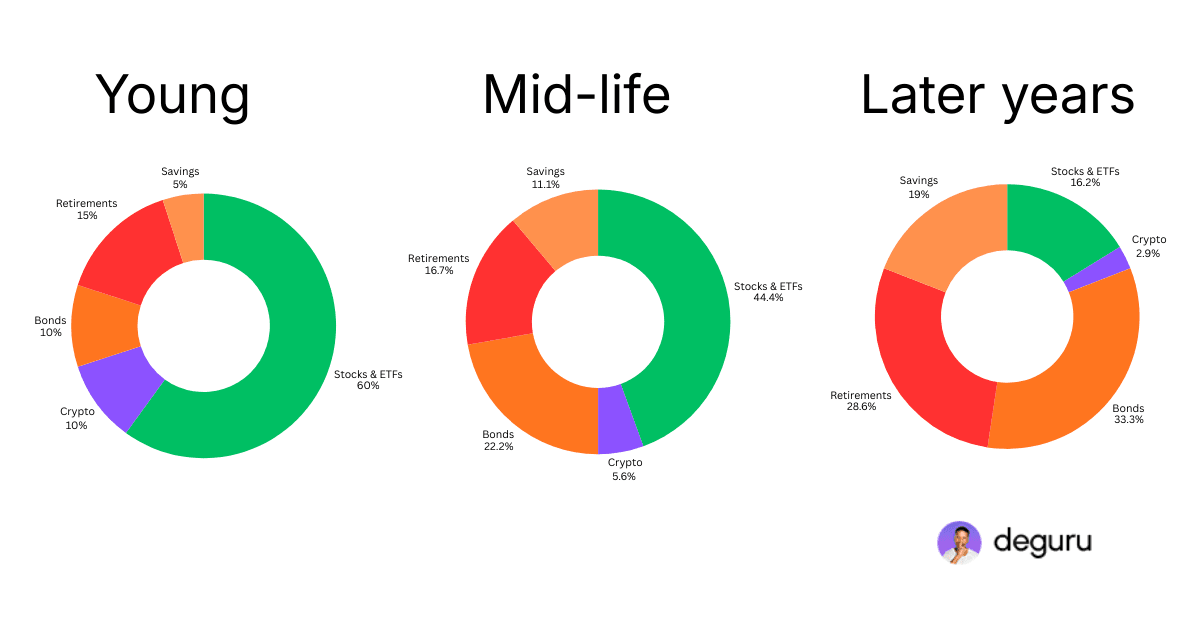

Your age matters because it decides how much risk you can afford.

The younger you are, the more time you have to recover from market drops.

You don’t need perfect timing. Jim Simons started investing when he was 40 years. You need the right mix for your age.

ROI (Return on Investment) Calculator

Now you are an investor. Quickly see your investment returns with this simple ROI calculator. Just enter what you invested and what you sold it for, and find out if you made a profit or a loss.”

FAQs

Use the formula

Example in words:

If you invested $1,000 in a stock and later sold it for $1,200:

So your ROI is 20%, meaning you earned 20% of your original investment.

In these sectors, Healthcare, Utilities, and Consumer Staples. In a recession, natural disasters, or even war, people still need medicine, electricity, and groceries.

Saving is putting money aside safely for short-term needs, usually in a bank.

Investing is using money to try to grow it over time, usually with stocks, bonds, or other assets, but with more risk.